Happy Wednesday! This will be our first every almost entirely free paid trading letter to introduce people to what it is.

Covered in this letter:

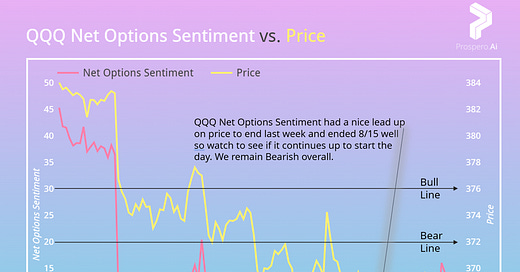

Higher frequency QQQ and SPY Net Options Sentiment / Market Update we accidentally double posted SPY in the other letter this has the real QQQ

Net Options and Social Sentiment Movers

Model portfolio update

Advanced trading recommendation

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

Market and Prospero Portfolio Update

Market Risk Update: QQQ: 3.25 (out of 10) SPY: 4 (out of 10)

If you are 100% long in this market we would suggest suggest 20% of your portfolio to be in SQQQ to hedge what we would call significant downside risk.

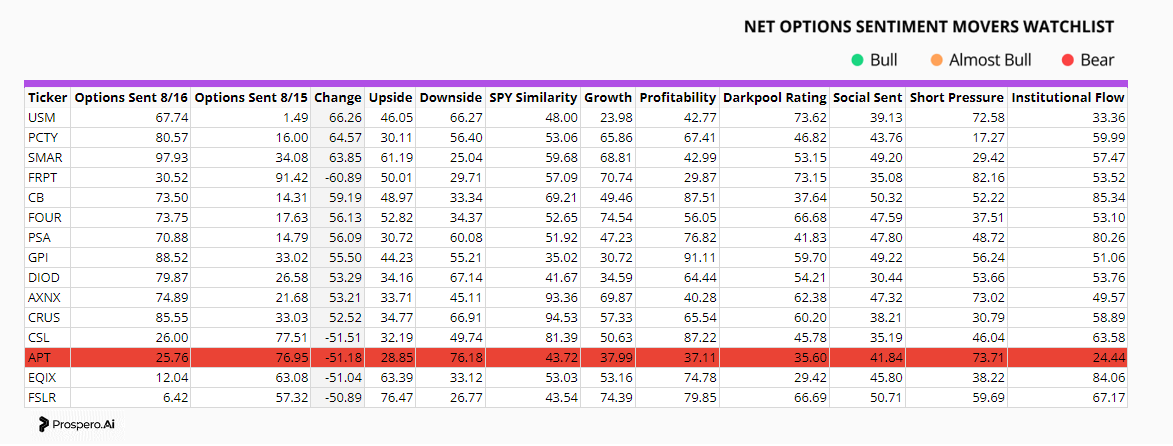

If you can’t read the below picture, this link has the same information. *Tickers on the watchlist are not recommended unless highlighted

We love APT as a new Bear, consider us entering it as of the sending of this letter for our Model Portfolio. (63% win rate on 110 trades)

If you can’t read the below picture, this link has the same information. *Tickers on the watchlist are not recommended unless highlighted

Entering WIRE as a Bull as I like the strong profitability along with fast climbing Net Social and good Net Options Sentiment.

Entering MMM as a Bear as I’ve been watching it for a bit and the declining Net Social Sentiment and low Net Options Sentiment make it an attractive entry.