We are at 26% above the S&P 500 on our Model Portfolio, with a 58% win-rate per pick against S&P 500 benchmarks. That might seem a lot less impressive than 53% and 60% on our 2023 newsletter picks. But we have about 5X in 1/2 the time (started 6/4/23) at 10X the churn I’m actually more proud of the model portfolio number. The closer you get to 500 investments the harder it is to beat the market and more likely you lose. Especially if you are churning through them that fast.

We have a lot of new sign ups after my speaking event at the Modern Investor Summit so I’m doing this letter a little differently. This letter will be free until we give our new picks that will be paywalled at the bottom. If you saw our Sector update this morning you can skip it now.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

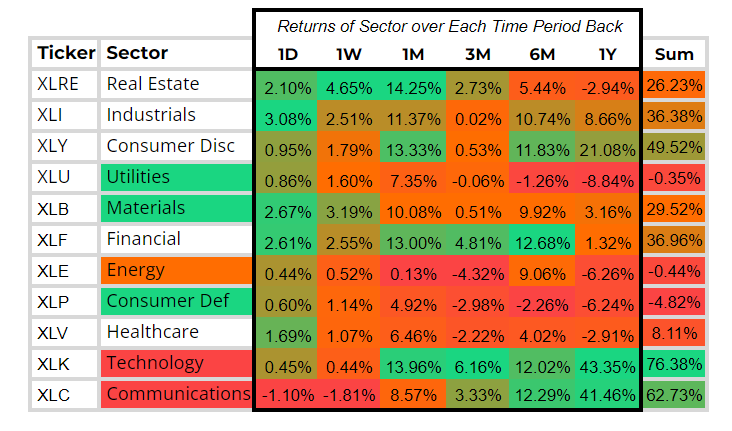

Sector Analysis from 12/3

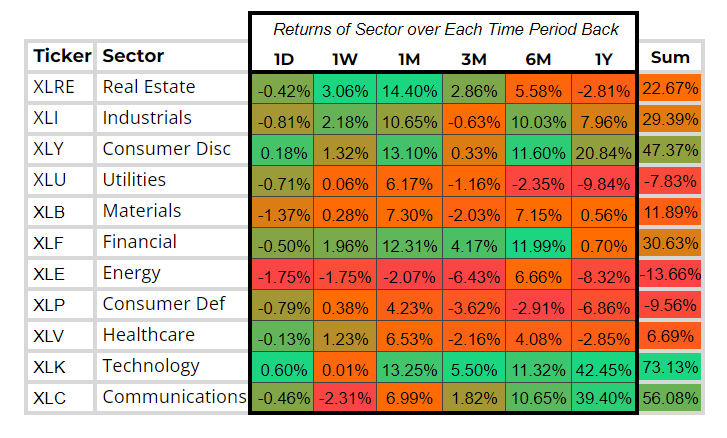

Sector Analysis Today

The big thing to note here is that technology might very well have been a short correction and Communications problems might be more persistent (we mentioned this on our livestream yesterday)

And Materials might not be ready to be the big winner we want it to. But perhaps Financials are ready to come back more than we thought.

Portfolio Update

Exit long - CMG, ADBE

Exit short - RLAY, COF

Screener of the Day

This was filtered out like this:

Bull Sectors: Health Care, Consumer Discretionary, Industrials, and Utilities

Bear Sectors: Tech, Energy, Consumer Defenseive

Long REGN

Short QMCO, E, CNX