Hi all. If you’re like me, you’ve probably found the last 2 weeks a bit frustrating. With NOS for SPY 0.00%↑ and QQQ 0.00%↑ (see SPY 0.00%↑ below), range bound, what’s a trader to do?

Below is the volatility skew for $SPY. Note that the solid line is within the cloud, this indicates any moves will be muted with mean reversion.

Trying to day trade this environment typically results in most retail traders buying on the high (false breakout) and selling or stopping out at the low.

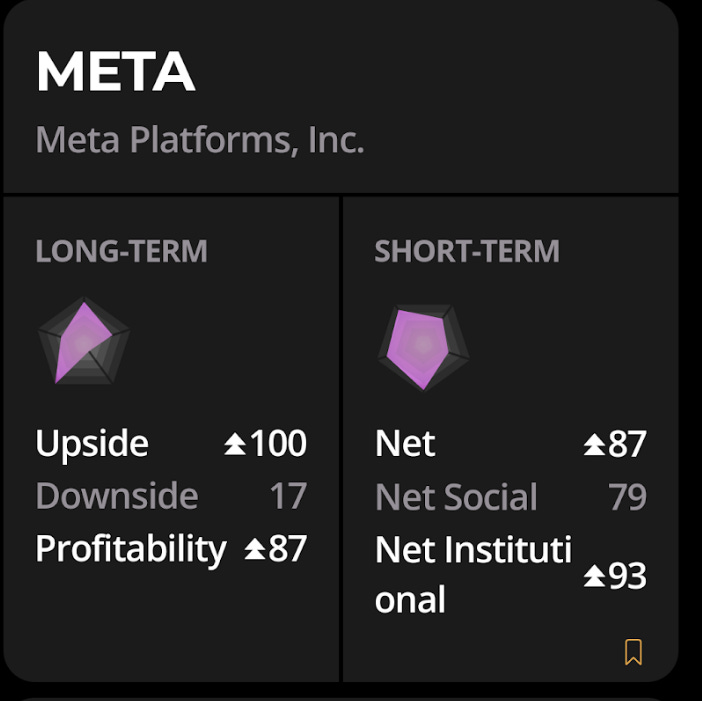

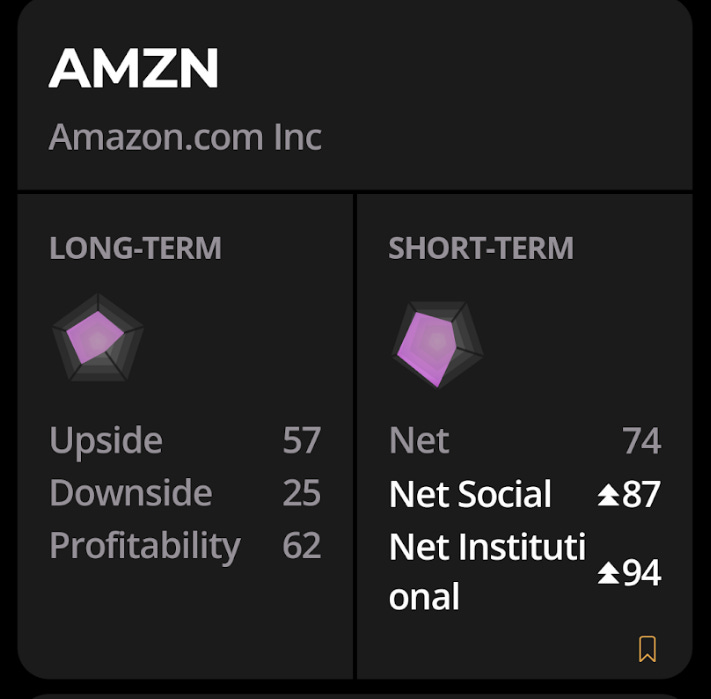

Looking at the short-term and long-term bulls in the Prospero app we can profit using the ranges to our advantage. We do this by selecting some of the more liquid equities (*these will be options day trades) and adding those to our charts. For tomorrow (Friday), I will be watching $META, $AMZN and $NVDA.

Our decision to go long or short will be based on pre-market activity and we will exit at support or resistance. In other words, we will buy when most are stopping out and exit when FOMO sets in and others start to buy. These trades tend to last only 1-2 hours. I will post more details below and post my trade(s) in Discord.

Trade well and be safe.